This is a guest post authored by the research team at Quantum Mutual Fund. It is one of India’s premier asset management companies with 1,440.45 Cr of Assets under Management as of 30th June 2020.

This is a guest post authored by the research team at Quantum Mutual Fund. It is one of India’s premier asset management companies with 1,440.45 Cr of Assets under Management as of 30th June 2020.

The number of confirmed cases of COVID-19 is multiplying by the day. Many parts of the world are already witnessing the second wave of coronavirus, which according to health experts may make India’s position vulnerable. At the time of publishing this blog post, India occupies the second spot on the list of infected nations.

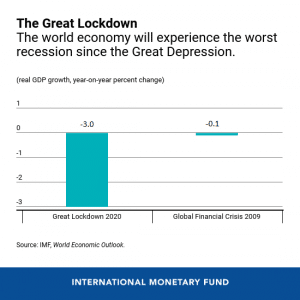

As a result of this pandemic, the world is staring at an economic uncertainty. Fear of a global virus-led recession looms large. The IMF has observed that the COVID-19 crisis is like no other.

The IMF fears a virus-led global recession

As per the IMF’s World Economic Outlook Update, June 2020, India’s GDP is expected to contract by 4.5% (a “historic low”) due to a longer period of lockdown and slower-than-anticipated recovery in the fiscal year 2020-21. However, the report expects India’s GDP to bounce back in the next fiscal year, with an expected growth rate of 6%. That said, this rate is lower than the average GDP growth of 6.2% estimated for ASEAN-5 countries (Malaysia, Indonesia, Philippines, Singapore, and Thailand).

Apart from the COVID-19 crisis, geopolitical tensions are on the rise as well.

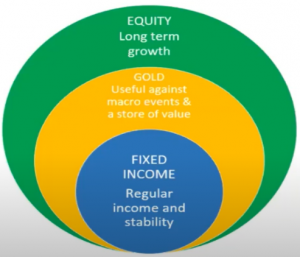

This might lead to an environment of amplified risk, which might affect the equity and debt markets. Amidst this turbulence, gold as an asset class has held strong, and gained in value, acting as a safe haven.

In these uncertain times, asset allocation is key. Parking all the investible surplus in a bank fixed deposit out of fear of losing money may not be the right approach. Similarly, going gung-ho because the markets are doing well might not be a prudent investment approach either. In the words of the legendary investor, Mr Warren Buffett:

“Be fearful when others are greedy and greedy when others are fearful.”

What is the prudent approach?

Devising a sensible asset allocation.

That’s why asset allocation has justifiably been termed as the cornerstone of investment planning.

What is asset allocation?

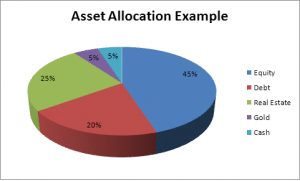

Asset allocation, as the name implies, refers to distributing your investible surplus across asset classes such as equity, debt, gold, real estate, or holding cash.

Distribution of investible surplus across asset classes

Every asset class has a risk-return profile that is suitable for a certain level of personal risk appetite, investment objectives, financial goals, and the time horizon to achieve them.

To mitigate the risk and earn risk-adjusted returns, it is important to diversify investments across asset classes and investment avenues.

Fundamentally, it is important to keep in mind that all asset classes do not always move in the same direction at the same time. When equities are witnessing a correction or volatility, other asset classes viz debt and gold would generally balance the returns of the investment. Hence, prudent asset allocation is essential to meet your financial goals and investment objectives.

Given below is a series of growth of different assets over the years.

Various Assets’ growth over the years

Since different assets have varied performance, investing in multiple assets could reduce the shocks caused due to underperformance of any single asset at any point of time. Prudently thought-out asset allocation acts as a shield, particularly when the economy is witnessing turbulence and markets turn volatile.

To optimise the returns on investments while taking the edge off the risk involved, asset allocation plays a pivotal role. Asset allocation, therefore, is essentially an investment strategy in itself that can balance the portfolio’s risk and reward.

How should you allocate your assets?

Asset allocation can be crafted broadly in two ways: by risk profile; and based on your financial goals being addressed.

Asset allocation approach in Crux

In conclusion

An intelligently crafted asset allocation drives eight great benefits:

- Diversifies the portfolio, which is one of the basic tenets of investing;

- Reduces dependence on a single asset class;

- Serves as a safeguard when a certain segment of the capital market hits turbulence;

- Lowers investment risk;

- Provides freedom from timing the market;

- Ensures adequate liquidity of the portfolio;

- Earn efficient inflation-adjusted returns; and

- Helps achieve the envisioned financial goals

Asset Allocation can serve as an astute investment strategy that will pave the path to sensible wealth creation, which is always good for your long-term financial well-being.

Happy Investing!

The opinions expressed are those of the authors and should not be construed as advice from Kuvera.

Disclaimer, Statutory Details & Risk Factors:

The views expressed herein this article/video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide/investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Risk Factors: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.