In 1981, Rolf Banz, then a PhD student at The University of Chicago wrote his dissertation on pricing of small companies in the US. In his thesis “The relationship between return and market value of common stocks”, Banz noted –

It is found that smaller firms have had higher risk-adjusted returns, on average, than larger firms. This ‘size effect’ has been in existence for at least forty years… The size effect is not linear in the market value; the main effect occurs for very small firms while there is little difference in return between average-sized and large firms.

And thus started the focus on the “small firm effect”, the “size factor”, or the “small-cap alpha”.

The interest in small firm outperformance is obvious – a simple factor i,e the small market capitalization of a firm predicts higher future returns. One doesn’t need to understand accounting, know financial ratios or know anything about what the company does. Just that it is a small company. The investment advice it entails is equally simple – buy a basket of small companies, ideally, a small-cap index fund and you shall reap the benefits of small firm outperformance.

But markets are dynamic. Once that small firm effect was identified, a lot of money started flowing into small companies to take advantage of it. Ove time that has reduced the small firm effect, but it is still observable in most global markets.

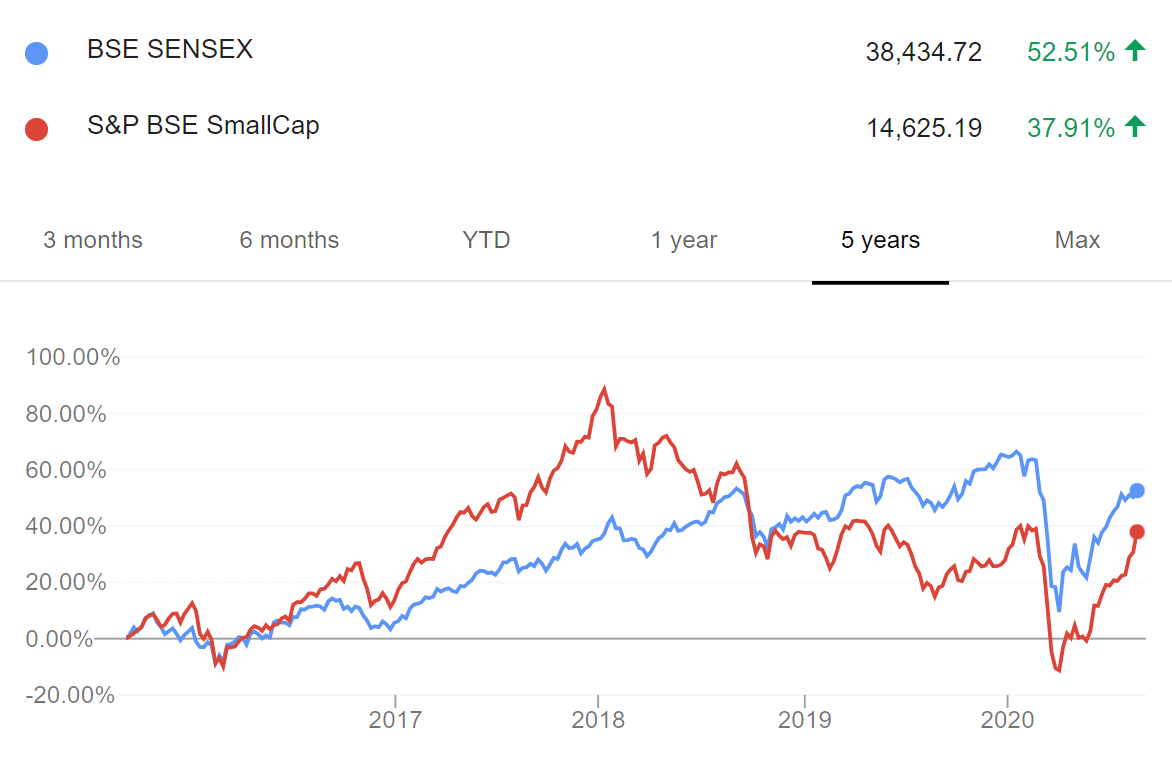

Where does that leave us as investors in Indian stocks? To begin, SEBI defines small-cap companies as 250 or smaller in the market capitalization rank. Per the latest AMFI data that would be companies with a market capitalization of Rs 7,000 Crores or lower. Lets quickly eyeball how the small-cap index has done versus large-cap index in India.

A couple of things fall out.

1/ In the long run (data is since 2003), the small-cap index has had marginally higher returns than large-cap index.

2/ The small-cap index returns have been very volatile, making higher highs and then reverting to the large-cap index returns.

In the last 5 years, the story has been slightly different. The small-cap index has returned less than the large-cap index but made a higher high in 2018.

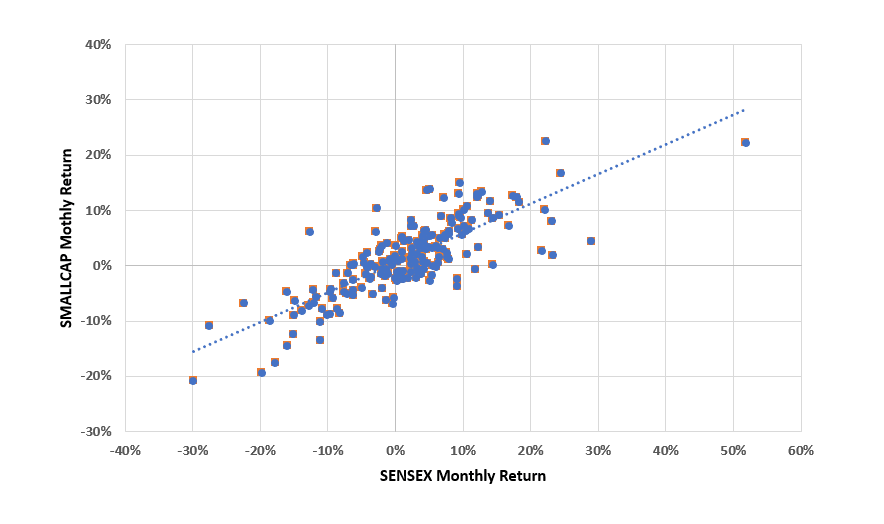

So the inference is that over long term small-cap index will outperform but with higher volatility. What we find out by running a monthly regression of small-cap index vs the large cap-index is that adjusted for the higher volatility the small-cap index does not outperform the large-cap index. The slight outperformance of small-cap index over the past 17 years or so (first chart) is just compensation for holding an asset that is more volatile. Or as they say in financial jargon, the small-cap alpha in India is 0% whole beta is 1.17 🙂

What does that mean from an investor behaviour perspective? One, be prepared to be invested in small-caps for the long haul – think 10 years or higher. Also, be prepared for a lot of volatility and don’t stop investing (SIP or lumpsum) even when the small-cap index is not doing well.

This is easy to say but hard to practice. We know from the behaviour gap and countless such studies that most investors chase performance. Following good returns, investors jump into the small-cap space, as happened in 2017 and 2018, and then following sub-standard returns they either stop investing more or even worse move to some other funds, as has happened in 2019 and early 2020. This behaviour is not isolated. A study of investors in 7,125 Mutual Funds in the US over a 13 year period concluded –

Over 1991–2004, equity fund investor timing decisions reduce fund investor average returns by 1.56% annually. Underperformance due to poor timing is greater in load funds and funds with relatively large risk-adjusted returns.

In simple words, investor underperformance is higher in funds with large volatility – just like the small-cap index or small-cap funds. Adjusted for this, investors do not make higher returns by investing in small-cap funds than they would make by investing in large-cap funds. And that’s that!

We discussed small-cap investing in a recent #KuveraInsights video with Navneet, CIO at SBI MF and Bijoy, Asst Editor at Cogenics. We discuss the ups and downs of investing in small-cap funds and the deep research that backs investment decisions in the stocks chosen.

This week in #KuveraInsights we talk bad loans and rising bank NPAs with columnist and best selling author Vivek Kaul. Ever wondered how all of us are financing the NPA crisis? Do you know who is the biggest bank loan defaulter – no it is not Vijay Mallya or Nirav Modi? We discuss this and a lot more. A must watch!

|

Announcement

1/ SEBI has penalized State Bank of India, Life Insurance Corporation of India and Bank of Baroda for failing to reduce their stakes in UTI AMC.

2/ Principal Mutual Fund has appointed Douglas Alan Fick as an Alternate Director to Pedro Borda, on the Board of Principal Asset Management Private Limited.

3/ BOI AXA Mutual Fund has appointed Girish Kumar Singh as an Associate Director of BOI AXA Investment Managers Private Limited.

4/ Mirae Asset Mutual Fund has appointed Somak Banerjee as Investor Relations Officer and K Ramasubramanian as an Associate Director (Independent) on the Board of Mirae Asset Trustee Company Private Limited.

Quote of the week:

I don’t take on big things. What I do, pretty much, is make the big things small and the small things big.

:Larry David

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!