If given a chance to invest in either physical gold or a mutual fund that mirrors the price of gold, what would you choose?

Gold, also known as the safe haven asset, is one of the most valued asset classes that has maintained its stability throughout the history of mankind. It is evident from the markets at large that gold has a negative correlation with the equity markets. More often than not, the sinking of the equity markets is often accompanied by an increase in the gold rate, which explains why gold is generally included in portfolios as a hedging asset.

Why Would Gold Be A Good Investment?

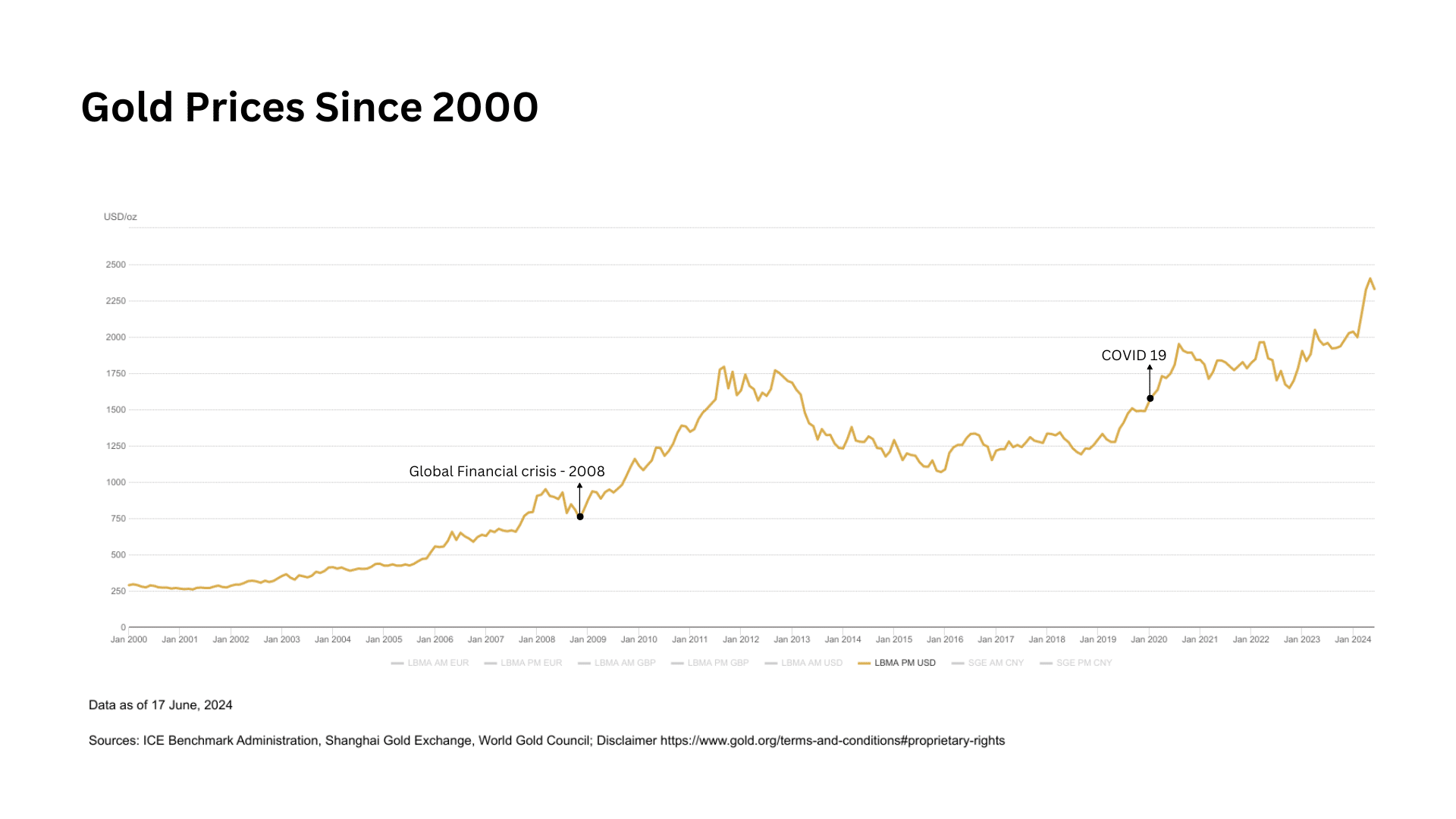

Gold is often considered a good investment because it can be utilised to preserve wealth over the long term. Its performance during economic downturns differs from other asset classes, so it can be used as a hedge against inflation. Historical data shows that gold retains value even when currencies lose their purchasing power. For example, during the 2008 financial crisis, gold prices increased while stock markets plunged, protecting investors from significant losses.

Take a look at this line chart which tracks gold prices since 2000.

Here’s a chart showing the top 10 gold reserves:

While officially abandoned in the 1970s, #Gold reserves still find favour of central banks in times of economic uncertainty. A look at the top 10 countries with the most gold reserves in Q1 FY 2024??#ChartOfTheDay #GoldReserves pic.twitter.com/zKiDYaNJdW

— Kuvera (@Kuvera_In) June 13, 2024

What Is A Physical Gold Investment?

Physical gold investment refers to purchasing actual gold in the form of gold bars, gold coins, gold biscuits or jewellery. This form of investment involves owning tangible assets.

You hold actual metal this way, which can provide you with a sense of security. However, physical gold also requires storage and insurance costs compared to gold-based financial products. Investing in physical gold can be a way to diversify one’s portfolio and hedge against inflation.

What Are Gold Financial Instruments?

They are financial products that derive their value from gold. They include gold mutual funds, gold exchange-traded funds (ETFs) and gold futures contracts. Here are the differences between different gold financial instruments:

| Basis of Difference | Gold Mutual Funds | Gold ETFs | Gold Futures Contracts |

| Management | Could be actively or passively managed | Passively managed; tracks the price of gold | Not managed; it’s a financial contract |

| Trading | Bought and sold through the fund house | Traded like stocks on an exchange | Traded on futures exchanges |

| Underlying Asset | Physical gold, gold-related stocks or both | Physical gold or gold receipts | Contract based on future price of gold |

| Minimum Investment | Variable, often lower than ETFs | Typically one unit of the ETF | Depends on the contract size, usually higher |

| Mode of Investment | Through mutual fund companies or platforms | Through stock exchanges | Through brokerage firms |

| Exit Loads | May have exit loads | None, but brokerage fees apply | None, but may have brokerage/margin costs |

| Systematic Investment Plan | Available | Not typically available | Not available |

| Demat Account Requirement | Not Required | Required | Not required |

Is It Wise To Invest In Gold Now?

The decision to invest in gold depends on current macroeconomic conditions, market trends and your financial goals. Typically, gold is a good investment during times of economic uncertainty and high inflation.

Like for example, If inflation rates are rising, you might consider gold to protect against the depreciating value of the currency.

Start investing in Index Funds.

What Are The Risks With Investing In Physical Gold?

Investing in physical gold comes with risks such as theft, storage costs and liquidity issues. Additionally, physical gold does not generate income like dividends or interest similar to stocks and bonds.

Hence, you have to incur additional costs for secured storage and insurance to protect your gold holdings from theft.

How Do Gold Mutual Funds And Gold ETFs Work?

Gold mutual funds are investment vehicles that invest in gold ETFs whereas gold ETFs directly hold physical gold and are traded on stock exchanges. They track the value of ETF units and reflect the value of physical gold. The main difference between them lie in their direct ownership of gold and the investment approach—Gold mutual funds invest in ETFs to gain exposure to gold while gold ETFs hold physical gold.

Here are the top 5 gold mutual funds based on 1-year returns as of 18th June 2024:

| Gold ETFs | AUM | 1Y | 3Y | 5Y | TER |

| IDBI Gold Growth Direct Plan | ₹54 cr | 20.6% | 13.6% | 15.7% | 0.3% |

| LIC Gold ETF FoF Growth Direct Plan | ₹54 cr | 20.6% | 13.6% | 15.7% | 0.3% |

| HDFC Gold Growth Direct Plan | ₹2042 cr | 20.3% | 13.1% | 15.9% | 0.2% |

| Invesco India Gold ETF FoF Growth Direct Plan | ₹74 cr | 20.2% | 13.0% | 15.8% | 0.8% |

| Aditya Birla Sun Life Gold Growth Direct Plan | ₹354 cr | 20.1% | 13.1% | 15.8% | 0.7% |

What Are The Tax Implications For Investing In Physical Gold?

Physical gold investments are subject to capital gains tax when sold at a profit. If the physical gold has been held for less than 36 months, the profits are treated as short-term capital gains (STCG) and taxed at your applicable income tax slab rate.

But if the physical gold has been held for more than three years, the profits are treated as long-term capital gains (LTCG) and taxed at a flat rate of 20% after applying indexation benefits.

Can Investing In Gold Help During Inflation?

Gold is traditionally seen as a hedge against inflation because its value tends to increase when the cost of living rises. Thus, preserving your purchasing power.

How Liquid is Gold As an Investment?

Physical gold can be less liquid than financial instruments like mutual funds and ETFs. Selling physical gold quickly involves finding a buyer and potentially accepting a lower price. However, gold ETFs offer higher liquidity as they can be traded on stock exchanges.

You can sell shares of a gold ETF during market hours, whereas selling physical gold might take longer and incur higher transaction costs.

How Can I Store And Insure My Physical Gold?

Physical gold can be stored in home safes, bank lockers, or specialised vaults. Thus, insuring gold protects it against loss or theft.

How Do I Start Investing In Gold Financial Instruments?

In case of gold mutual funds, you don’t need a demat account. Simply login to your Kuvera account and start investing. However, for gold financial instruments like Gold ETFs, you have to open a demat account with a brokerage firm and make a purchase through the trading platform.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: All About Sectoral & Thematic Funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.