Historically, gold has always been a valuable commodity. Historians have not found a fixed date or time when gold was discovered but it is most likely that gold was discovered in rivers or streams due to its shiny nature.

In the past, people who have invested in gold have been able to navigate economic fluctuations much easier than others. This makes it a sensible investment option even today.

History of gold performance

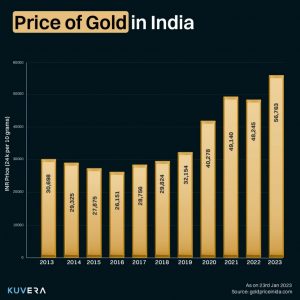

Even today, gold is a sensible investment for investors. Gold prices over the years have been stable and there have not been many drastic fluctuations in the price of gold. The purchasing power of gold has also remained constant as compared to other assets and currencies.

In 1964, 10 grams of 24 kt gold was priced at ₹ 63.25

10 grams 24 kt gold price in 2022 was ₹53,172

24 Kt gold price last year, in 2023 was ₹61,000

24 Kt gold price today in 2024 is ₹75000

Even if you see the value of gold in the past decade, the price has been relatively stable and has mostly appreciated over the years.

When the rest of the world is going through so many economic crises which have led to sky-high inflation and fear of recession mounds. This makes most investments volatile and currency becomes dearer as its purchasing power decreases. The price of gold has been mostly rising steadily and is at an all-time high in April 2023. This means that people who have invested in gold have a better probability of getting a higher ROI than they have with other instruments.

Gold investments are a tried and tested form of investment as they have stood the test of time and have historically performed well during times of crisis. They are also a great way to diversify your portfolio.

Top reasons to invest in gold

- Gold acts as one of the most stable hedge against inflation

- Gold is a store of value and it’s value generally doesn’t deteriorate with time

- It is highly liquid and can be sold any time to get funds

- Helps in portfolio diversification

Click here to see more reasons gold is a sensible investment in India.

Various ways to invest in gold

There are several ways to invest in gold in India, including:

- Physical Gold: This includes purchasing gold in the form of jewelry, coins, or bars. It is a traditional way of investing in gold in India.

- Gold ETFs: Gold Exchange Traded Funds (ETFs) are open-ended mutual funds that invest in gold. These funds are traded on the stock exchange, and investors can buy and sell units of these funds on the exchange.

- Gold Mutual Funds: Gold mutual funds invest in gold mining companies, and they are ideal for those who want to invest in the gold industry but do not want to buy physical gold.

- Sovereign Gold Bonds: The government of India issues Sovereign Gold Bonds periodically. Investors can buy these bonds, and the value of the bond is linked to the current market price of gold. These bonds offer interest on the invested amount and are a good investment option for long-term investors.

- Digital Gold: Digital Gold is a new way of investing in gold, where investors can buy and sell gold digitally. Several platforms offer digital gold investment options, and investors can buy as little as 1 gram of gold.

- Gold Saving Funds: Gold Saving Funds are mutual funds that invest in gold ETFs. Investors can invest in these funds through a Systematic Investment Plan (SIP).

- Gold Futures and Options: Gold futures and options are derivatives products that allow investors to trade in gold without actually owning the underlying asset. These products are ideal for those who want to trade in gold but do not want to invest in physical gold.

If you have already made gold investments, then you can track your investments easily on Kuvera. To see how you can track your gold investment through Kuvera, watch the video at the bottom of the page.

Things to consider before investing in gold

- Convenience: For those who value convenience, investing in digital gold or gold ETFs may be the most efficient way to invest in gold as they can be easily bought and sold online.

- Liquidity: If liquidity is a priority, investing in physical gold may not be the most efficient option as it can be more challenging to sell quickly than other forms of gold investments. In contrast, investing in gold ETFs or digital gold can offer higher liquidity as they are traded on the stock exchange.

- Cost: The cost of investment can vary among different forms of gold investments. For instance, buying physical gold can come with additional expenses such as making charges, storage fees, and insurance. On the other hand, investing in gold ETFs or digital gold may come with lower transaction fees and management fees.

- Risk: Investing in gold mining companies or gold mutual funds can be riskier than investing in physical gold or gold ETFs as it is dependent on the performance of the company.

Tax benefit of investing in gold

The taxation of gold investments in India varies based on the form of investment. Here are the tax implications for different forms of gold investments:

- Physical Gold: If an individual sells physical gold after owning it for more than three years, it is considered a long-term capital asset, and a capital gains tax of 20% with indexation is applicable. If the physical gold is sold within three years of purchase, the gains are considered short-term capital gains and are taxed at the individual’s income tax slab rate.

- Gold ETFs: The taxation of gold ETFs is similar to equity-oriented mutual funds. If an individual holds the units of a gold ETF for more than one year, it is considered a long-term capital asset, and a capital gains tax of 10% without indexation or 20% with indexation is applicable, whichever is lower. If the units are held for less than one year, it is considered a short-term capital gain, and the gains are taxed at the individual’s income tax slab rate.

- Sovereign Gold Bonds: The interest earned on sovereign gold bonds is taxable as per the income tax slab rate of the individual. If an individual holds the bond until maturity, no capital gains tax is applicable.

- Gold Saving Funds: The taxation of gold saving funds is similar to that of gold ETFs.

- Digital Gold: The taxation of digital gold is similar to that of physical gold.

It is important to note that the above tax implications may vary based on an individual’s income, tax status, and other factors. Therefore, it is recommended to consult a tax expert or financial advisor to understand the tax implications of gold investments in India.

Conclusion

Investing in gold has been a part of Indian culture and tradition for centuries. While the decision to invest in gold is a personal one and should be based on individual financial goals, there are several reasons why gold remains a viable investment option in 2023. From its historical performance in India to the various ways to invest, there are multiple ways for investors to participate in the gold market.

Additionally, factors such as inflation, currency fluctuations, and geopolitical tensions all contribute to the appeal of gold as a safe-haven asset. Finally, investors in India can also enjoy tax benefits associated with investing in gold, making it an attractive option for those seeking to diversify their portfolio. Ultimately, while gold may not be the right investment choice for everyone, it remains a valuable asset class that should be considered as part of a well-diversified investment strategy.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.