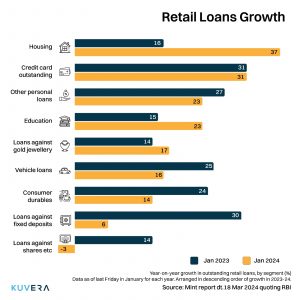

Did you know retail loans in India are rising rapidly?

A growing economy like India needs funds and majority of these funds come in the form of loans from banks and NDFCs.

As of November 2023, banks had lent over ₹50 trillion to individuals and households. The amount given in personal loans was about 40% higher than the ₹36 trillion lent to industries, as reported by Mint.

RBI data also shows a notable increase in credit card transactions, rising from Rs 1.61 trillion in November 2023 to Rs 1.66 trillion in January 2024.

This increasing need for funds has led to the gaining popularity of Loan against shares (LAS). So, what is LAS?

In this guide, we’ll understand all about loans against shares, how they work, their growing popularity in India, eligibility criteria, and the regulatory framework governing them.

What are Loans Against Shares?

Loans against shares (LAS) are a type of loans that provide investors the opportunity to borrow funds by using their shares as collateral.

This type of loan has become popular in recent times because they allow quick cash without selling off the stock holdings and disturbing the portfolio. LAS allows investors to leverage the value of their investment portfolio while retaining ownership of their shares.

How do Loans Against Shares Work?

When investors opt for LAS, they approach NBFCs or banks, pledging their shares in return for a loan. Other than shares, bonds, insurance policies and mutual funds are also accepted as collateral. Such loans are provided as an overdraft facility. You can withdraw any amount within the specific loan limit, which is typically based on the value of the pledged asset.

Interest rates on LAS typically range from 10.5% to 13%, depending on the lender’s policies and market conditions.

The Growing Popularity of LAS in India

The rising need for retail loans in India has fueled the growth of LAS, particularly among high net-worth individuals involved in stock and derivatives trading. These individuals often possess substantial investment portfolios that serve as attractive collateral for lenders.

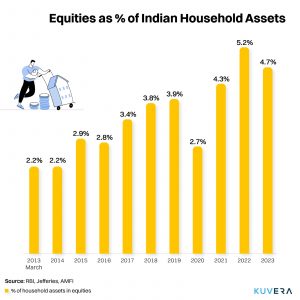

Indian households are also investing in the stock market more than ever, with investments in equities steadily increasing. This makes loan against shares a convenient option for these households looking for quick access to funds.

While the percentage of LAS within the total lending landscape remains small, their increasing popularity has led RBI to lay some ground rules.

Regulatory Oversight and Concerns

RBI plays a crucial role in regulating LAS practices to ensure market stability and protect the interests of lenders and borrowers. RBI’s recent regulations stipulate that only group 1 shares, characterized by their trading frequency and impact cost, are eligible as collateral for LAS. This regulatory framework aims to mitigate risks associated with LAS and prevent market volatility.

RBI also has an extensive list of guidelines for loan against shares to protect borrower’s interests.

Eligibility Criteria for Loans Against Shares

To qualify for a loan against shares, individuals must meet certain basic eligibility criteria, these can differ from lender to lender. Some of these includes:

- Age between 18 to 65 years.

- Shares must be held in the individual’s name.

- Submission of essential documents such as identity proof, proof of address, proof of income, and demat holding statement.

- Shares cannot be pledged if held in the name of minors, Hindu Undivided Families (HUFs), Non-Resident Indians (NRIs), or corporations.

- Additionally, shares of companies in which the borrower is a Director or Promoter cannot be pledged.

What are the benefits of Loans Against Shares?

- Immediate Liquidity: Allows investors to access funds quickly without selling their shares.

- Retention of Ownership: Borrowers retain ownership of their shares while using them as collateral.

- Flexibility: Funds can be used for various purposes, including personal expenses or investment opportunities.

- Lower Interest Rates: Interest rates on loans against shares are often lower compared to unsecured loans.

- No Credit Check: Since the loan is secured by collateral, lenders may not require a stringent credit check.

Cons of Loans Against Shares

- Market Risk: If the value of the pledged shares declines significantly, borrowers may face margin calls or need to pledge additional collateral.

- Interest Costs: Borrowers must pay interest on the loan amount, which can accumulate over time and increase the overall cost of borrowing.

- Limited Loan-to-Value Ratio: Lenders typically offer loans up to a certain percentage of the value of the pledged shares, limiting the amount borrowers can borrow.

- Potential Loss of Shares: If borrowers fail to repay the loan, lenders may liquidate the pledged shares to recover the outstanding amount.

Loans Against Shares can be valuable liquidity solution for investors if used carefully. Loan Against Securities (LAS) allows individuals to use their securities like stocks, bonds, and mutual funds as collateral for a loan. The loan amount is usually a percentage of the market value of the pledged securities. LAS is becoming more popular due to its flexibility and lower interest rates compared to unsecured loans. To qualify, you typically need Indian citizenship, a Demat account, enough eligible securities, a good credit score, and stable income. Fees may include interest rates, processing fees, and prepayment charges. Various securities can be pledged, each with its own benefits and risks, so it’s essential to understand them before pledging.

FAQs

1. Can I get a loan against shares in India?

Yes, you can avail of a loan against shares in India. Many banks and non-banking financial companies (NBFCs) offer this facility to investors.

2. What are the RBI guidelines for loans against shares?

The RBI circular on loan against shares directs that the maximum LTV ratio for loans approved by NBFCs must be less than 50%. This means that if the value of your collateral security is Rs. two lakhs, the maximum loan amount that the lender can approve is 50% of Rs. Two lakhs which is Rs. One lakh.

RBI guidelines also stipulate that only group 1 shares, characterized by their trading frequency and impact cost, are eligible as collateral for such loans.

3. Can I borrow against the value of my shares?

Yes, you can borrow against the value of your shares by pledging them as collateral for a loan. This allows you to access funds while retaining ownership of your investment portfolio.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Index funds explained

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.