The global economy has not seen respite since 2019. While the after-effects of Covid were expected, the unexpected international conflict between Russia and Ukraine has added fuel to the fire. An all-hands-on-deck approach is being taken by most counties to stabilize the economy and prepare for any crisis.

Currently, the situation is precarious, consumers and investors are taking utmost precautions with their financial dealings. At home, the situation is more or less stable but there is still a looming cloud of uncertainty.

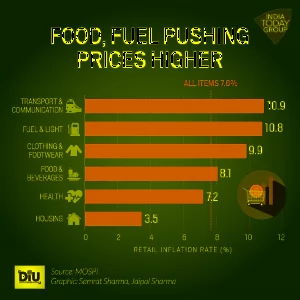

In any case, it has been seen in the past that the middle class experiences a major financial setback whenever there is a crisis. You might have already felt the pinch of rising real estate, fuel, and food prices in the past few months.

While the pinch is being felt by everyone, some might find it harder to navigate than others. If you are someone who just started their career or someone with a lot of financial responsibilities, the situation might get tricky for you.

The simplest and most effective way to handle this scenario is to plan your expenses to the T and notice any fluctuations in your spending. If you are yet to start budgeting, then it’s high time you get started.

A budget will not only help you keep track of your expenses but will also allow you to prioritize certain expenses and analyze the effect of inflation on your finances.

There is no one way to budget, ideally, you should customize your budget but here are a few tried and tested methods of budgeting to get you started:

-

The 50-30-20 Rule

This is the most commonly known method of budgeting. This follows a simple rule 50% of your income goes for needs, 30% for needs, and 20% for investing as well as savings.

This is a very basic budgeting method used by newbies. The income here is your net income and not gross income. Click here to learn 6 ways you can save more from your salary.

-

Envelope system

This method was mainly used by people who are heavily reliant on cash transactions. The idea is to create different envelopes and label them for different types of funds.

So, for example, you have 15000 and you want to allocate it to three types of spending. You will create 3 envelopes and add 5000 each for food, transportation, and bills. This way you will only spend what is there in the envelope for that particular expense.

While the method is traditional and not suitable for digital transactions. You can try digitizing the method by creating one fund for each expense.

-

Pay yourself first

This form of budgeting is largely used by small business owners who tend to reinvest their revenues back into the business.

This is a reverse system of budgeting where you first take out the expenses for yourself and then pay your bills and other expenses.

This kind of budgeting should be avoided for personal finances and especially for those who are just starting their budgets.

-

The zero-based budget

A zero-based budget is great for those who have a tendency to make impulsive financial decisions.

In this format, all of your disposable income is allocated to certain expenses. After allocation, you are not left with any surplus money. This prevents you from making any spontaneous and unplanned financial decisions.

You can allocate a certain amount for disposable spending if the method seems too difficult, to begin with. It is one of the most beneficial methods of budgeting.

No matter what the method is, it is important for you to start and be consistent with your budget. With the fear of financial crises always on the horizon, it is important for you to have some plan and structure for your financial habits. It will make you feel in control of your finances.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube: Expert advice: Investing in international markets

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.