Swapnil Kendhe is founder, SEBI registered investment adviser (RIA) and a fee-only financial planner at vivektaru.com. He charges a fixed annual fee for financial planning and investment advice directly from his clients.

How to invest a large amount: lumpsum or STP?

When investors have a large amount to invest, most struggle with the decision whether to invest through STP (systematic transfer plan) or invest lump sum (all in one go).

What is an STP (Systematic Transfer Plan)?

In an STP the investor invests the amount in a liquid or ultra-short fund and then systematically moves it to equity over a 6 month to 1 year horizon. You can setup an online STP on Kuvera and we will automate the monthly transfers from liquid to equity funds.

STP works well when markets go down or fluctuate in a range during the period of STP. Lump-sum turns out to be a better decision if markets go up after the lump sum is invested. Since nobody knows exactly how the markets will behave during the duration of STP or after the lump sum is invested, there is always a dilemma.

Is there a way out of this dilemma – enter asset allocation?

Yes, there is, if investors put the focus on the portfolio rather than viewing new investment in isolation.

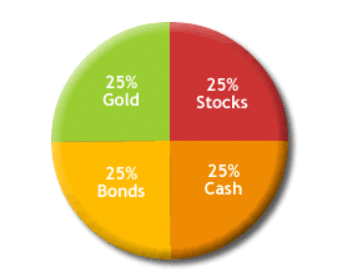

Money management at the retail investor level is all about asset allocation. Investors must first decide suitable asset allocation based on the time horizon and their risk tolerance. Equity should be avoided for short term goals. For medium-term and long-term goals anywhere between 20% and 75% equity allocation can be taken. Investors who lack investment knowledge, experience and conviction in equity, should start with conservative equity allocation.

Money management at the retail investor level is all about asset allocation. Investors must first decide suitable asset allocation based on the time horizon and their risk tolerance. Equity should be avoided for short term goals. For medium-term and long-term goals anywhere between 20% and 75% equity allocation can be taken. Investors who lack investment knowledge, experience and conviction in equity, should start with conservative equity allocation.

Once the asset allocation is decided, it should be religiously maintained in good times and in bad. Asset allocation can be occasionally tweaked if there are changes in life situations.

Kuvera Note

We provide a risk and goal based asset alloaction and recommended portfolio which you can see after planning your goals on Kuvera.

Because of fluctuations in equity markets, the asset allocation of the portfolio keeps changing. Rebalancing is used to get the portfolio back to its target asset allocation. Rebalancing is done by selling a portion of the asset that is over its target allocation and buying more of the asset that is under its target allocation.

Suppose the target allocation is 50:50 equity: debt. If after one year, an equity bull market moves portfolio allocation to 60:40 equity: debt, the extra 10% in equity is sold and moved to debt to get the portfolio back to its original asset allocation target. Likewise, if the drop in equity markets take portfolio asset allocation to 40:60 equity: debt, part of the debt portfolio is used to purchase additional equity and move portfolio allocation back to the target of 50:50.

Investors can decide a threshold for rebalancing. The threshold could be anything between 5% and 10%. So if 50:50 is the target equity: debt allocation and 10% is rebalancing threshold, investors should not rebalance the portfolio unless equity allocation breaches 40% on the lower side of 60% on the higher side.

Kuvera Note

We provide monthly re-balancing prompt advising our investors to rebalance if their asset allocation moves more than 5% away from our recommended allocation.

Threshold rebalancing requires some time to monitor and implement, and few investors can do it with discipline. Annual rebalancing that takes little time to implement is also good enough for most retail investors.

Invest lump sum, but based on your asset allocation

Rebalancing can also be done when new money is invested in the portfolio. The new money is invested in equity, debt, or both in such a way that it moves asset allocation of the portfolio towards the target allocation.

Rebalancing can also be done when new money is invested in the portfolio. The new money is invested in equity, debt, or both in such a way that it moves asset allocation of the portfolio towards the target allocation.

Suppose 50:50 is the target equity: debt allocation and current portfolio allocation is closer to 50:50, the new money is invested in equity: debt with 50:50 allocation. If the current equity: debt allocation is 40:60 against the target allocation of 50:50, all new money is invested in equity if it doesn’t take equity allocation over the target of 50%. Likewise, all the new money is parked in debt if the equity allocation of the portfolio is way above the target allocation.

The strategy of investing the lump sum in equity, debt, or both based on the asset allocation of the portfolio and rebalancing eliminates the need for STP. The amount is invested in one go without worrying about what markets may do next. It removes the risk of missing the action when a disproportionate percentage of total gains in equity markets occur rapidly in a short time. Equity markets could also correct significantly after we make the lump sum investment, but rebalancing helps take advantage of cheaper equity valuations.

Intuitively, STP looks a more sensible strategy, but investors can never know in advance the best duration for STP and if STP would bring down the average cost of purchase. STP works in bear markets but equally goes wrong in bull markets. In sideways markets, STP or lump sum doesn’t make much of a difference. The odds of getting a lower average cost of purchase are the same in both STP and lump sum.

When the odds are not convincingly in favour of STP, why not invest the lump sum based on the target asset allocation of the portfolio? This simple strategy if implemented without hesitation and procrastination, is more likely to lead to superior results over the long term against other strategies that involve different degrees of market timing.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Raakeysh

October 22, 2019 AT 19:13

Thanks for the information.

Gaurav Malhotra

November 19, 2019 AT 06:59

I fully agree with the author. Thanks for the article