The stock market is a vast and ever-changing world, with each country playing a key role. In this blog, we’ll explore the current state of global stock markets and the major contributors to the global stock market.

We will also take a look at the future predictions of the global stock market by Goldman Sachs’s ‘The Path to 2075 — Capital Market Size and Opportunity’ report.

Let’s dive into the present and future of the stock market.

The Present: Who’s in the Lead?

As of Q2 2023, the United States leads the way, making up a significant 42.5% of the world’s total stock market value. This dominance is remarkable and surpasses the European Union and other economies by a large margin. The U.S. stock market is massive, with a capitalization of over $46.2 trillion out of the 109 trillion global stock market. U.S. stocks have also performed exceptionally well over the years, outpacing most other developed countries. If you had invested $100 in the S&P 500 in 1990, it would have grown to about $2,000 by 2023.

Next in line is the European Union, with an 11.1% share of the global market, followed closely by China at 10.6%. These three players form the core of the global stock market.

The Future: What Lies Ahead?

Goldman Sachs Research, ‘The Path to 2075 — Capital Market Size and Opportunity’ provides insights into where global capital markets are headed. Despite a slowdown in global economic growth, the trend of incomes converging between emerging and developed economies remains intact. This means emerging economies such as India will continue to grab a bigger piece of the global economic pie.

In 2050, the top five economies are projected to be China, the U.S., India, Indonesia, and Germany. China is likely to become the world’s largest economy around 2035, and by 2075, the top three economies are expected to be China, India, and the U.S., with India possibly overtaking the U.S. This shift is driven by India’s growing population and strong economic growth potential.

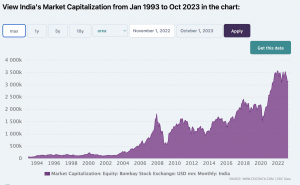

The relationship between stock market size and the income levels of a country’s people is an important factor. As emerging markets (EMs) grow their share of global stock markets, developed markets (DMs) are expected to see a gradual decline.

India is expected to lead this change, with its share projected to rise from around 2.5-3% in 2022 to a remarkable 12% by 2075. Other EMs are also set to see substantial growth, increasing their combined share from about 13.5% in 2022 to 30% in 2075.

Challenges and Risks

However, it’s essential to acknowledge the potential risks to these projections.

The biggest challenge would be the rapidly changing environment and the economic consequences of global warming.

Additionally, generative artificial intelligence is considered another crucial risk. Other risks such as political instability and wars also have major effect on this projection.

In conclusion, the global stock market landscape is in a state of transformation. As economic dynamics shift, emerging markets are poised for significant growth, making them increasingly important players on the global stage. While these projections offer a glimpse into the future, it’s essential to remain vigilant and adaptable to navigate the evolving landscape of global finance.

Interested in how we think about the markets? Read more: Zen And The Art Of Investing

Watch here: ELSS: Saving tax through mutual funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.