This is a guest post authored by the research team at Quantum Mutual Fund. It is one of India’s premier asset management companies with 1,440.45 Cr of Assets under Management as of 30th June 2020.

This is a guest post authored by the research team at Quantum Mutual Fund. It is one of India’s premier asset management companies with 1,440.45 Cr of Assets under Management as of 30th June 2020.

Life, at times, throws an unpleasant surprise when you least expect it. Some common situations are layoffs, pay-cuts, medical emergency, critical illness, natural calamities, car breakdown, hike in children’s school fees, and many others.

Such events can disrupt your plans. Withdrawing money from your investments to meet such expenses is not the best way to handle such emergencies because that could mean compromising your envisioned financial goals.

The best way to deal with such situations is to build an emergency fund. It is an essential part of money management. An emergency fund should be built while hoping for the best and preparing for the worst.

How to build your emergency fund?

To build an emergency fund you should take into account your monthly expenses. The thumb rule that can be followed to build an emergency fund is:

Emergency Fund = 24 times your monthly expenses

So, if your monthly expenses are Rs 50,000 then your emergency fund should be: Rs 50,000 x 24 = Rs 12,00,000. If you or your family members have a medical history, you should add 5%-10% extra for medical emergencies (considering health insurance cover, if any).

This is also the secret formula followed by Ajit Dayal, the founder of Quantum Mutual Fund while managing his finances.

Where to park the emergency fund?

Below are a few avenues to build an emergency fund-

Savings bank account – A portion of your emergency fund, say around 15% can be parked in a savings bank account, one which is not used regularly. This will earn you interest at 3.5-4% per annum, as opposed to it lying idle. That said, be careful of the bank you choose.

Bank recurring deposit – Around 10% can be allocated to term deposit for 24 months tenure that allows you to deposit a fixed amount every month and earn a better interest at 5-6% per annum. Again, be careful of the bank you choose and do not get lured to banks offering an exceptionally high rate of interest. With high return comes high risk and you should avoid high risk in emergency planning.

Liquid Funds – In addition to the above, you can consider investing a dominant portion, say around 75% in liquid funds. Choose liquid funds that have a good track record and prioritize safety and liquidity over returns. The objective of liquid funds is to provide optimal returns with a low-to-moderate level of risk while maintaining high liquidity through judicious investments.

As per SEBI norms, liquid funds invest in debt and money market securities with maturity of up to 91 days. The invested money is parked in market instruments such as Certificate of Deposits, Commercial Papers, Term Deposits, Call Money, Treasury Bills, and so on.

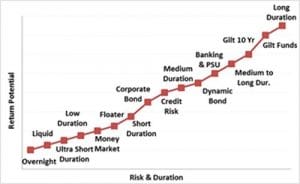

Positioning of Liquid Funds on the Risk-Return Spectrum –

Liquid funds are one of the low-risk products in the debt fund category. For this reason, liquid funds are placed at the lower end of the risk-return spectrum.

For the safety and liquidity of your emergency fund, deploying hard-earned money in liquid funds is a good option.

The category returns clocked by liquid funds for 2 year period ending August 11, 2020, was around 6.0%, slightly higher than the interest on bank term deposit. That being said, keep in mind that going by the investment mandate, the fund manager of a liquid fund is expected to prioritize the preservation of capital rather than maximizing returns.

In conclusion

Building an adequate emergency fund with a judicious mix of assets instills confidence to handle testing times and prepares you to manage financial stress.

Remember, the old proverb: A stitch in time saves the nine.

“Nothing is more imminent than the impossible…what we must always foresee is unforeseen.”

—Victor Hugo

Start building your Emergency Fund today!

Happy Planning & Investing!

The opinions expressed are those of the authors and should not be construed as advice from Kuvera.

Disclaimer, Statutory Details & Risk Factors:

The views expressed herein this article/video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide/investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Risk Factors: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.