Why do you need to keep track of your finances if you invest in capital markets?

Capital markets are highly charged environments that appeal to diverse investors. Investors have the discretion to select from various sectors and asset types. There are two routes by which one can start investing — the cash or the derivatives segment.

Margin trading is available in all main trading sectors, giving investors access to additional funds. It raises the degree of profit and loss. Because many investors trade in numerous markets, keeping track of funds becomes a little more complicated.

To simplify this task and promote clarity, stockbrokers forward the daily margin statement to assist investors in maintaining track of their finances. It makes investors confident in operating their accounts.

What is a daily margin statement?

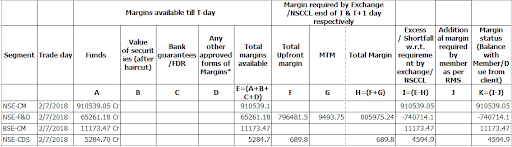

The daily margin statement provides a complete perspective of the margin status, including the amount deposited and used. As it’s a password-protected statement, you can unlock it after providing your PAN as the password. In addition, each trade includes a margin requirement. So, if you trade on numerous exchanges, the daily margin total will be mentioned.

How do you receive the daily margin statement?

When you first begin stock investment, your stockbroker will send you multiple emails with various statements, reports, etc. This statement informs the customer of their margin status, i.e., how much free margin is available in their account to set up new positions without suffering penalties or charges.

You will receive a consolidated daily margin statement if you trade on all exchanges. For a particular deal, it will contain all segments. For example, whether you trade on NSE EQ (equity), NSE F&O (equity derivatives), or NSE CDS (currency derivatives), the daily margin statement will include all of them.

The daily margin statement shall be issued on the T-Day (trading day). Once the transaction procedure for the day is completed, you may download the margin statements through your console login. Try to do this by 9:00 p.m. everyday.

What are the SEBI rules for daily margin statements?

While it may be difficult for a novice investor to comprehend all of these documents, the Securities and Exchange Board of India (SEBI) has compelled stockbrokers to deliver specific documents to their clients to maintain transparency. As a result, it’s critical to understand what these documents mean and what steps you should take (if any).

SEBI has instructed all trading members (stockbrokers) to collect margins from all retail investors. In other words, stockbrokers have to collect an advance fee from investors for any ‘buy’ or ‘sell’ transactions to maintain the proper operation of the markets. Failing to provide the appropriate margin may result in your deal getting canceled or other penalty charges.

SEBI also believes that investors should be updated on their margins daily to avoid deficits and associated fines. As a result, it has ordered that all stockbrokers deliver a daily margin statement to all investors daily.

How to read the daily margin statement?

The password-protected document tells an investor or trader about the available margin and its use. It informs an investor:

- How much free margin is accessible in their account, and where are they facing shortfalls?

- How to create new positions utilizing the available margin without incurring penalties?

SEBI has established a format for the daily margin statement, and as a result, stockbrokers must include the below details to maintain consistency and readability.

- Funds: The funds section includes the final balance after reversing the credit and charge for the trading day. T-day is the trading day, according to stockbrokers’ terminology.

For example, if you have deposited INR 70000 in your trading account, then the amount will be reported under the Funds column in the daily margin statement.

- This value of securities after haircut: When you sell a stock from your Demat account, the amount debited will get credited to the pool account. Because the exchange closes the deal on T+2 days, you also earn a margin benefit on equities in the pool account. The value of the stocks in the pool account is shown in the share market chart.

- Trade day: As the name implies, it means trading activity that occurs in a particular segment on a specific day. Because a margin statement is distributed daily, this portion will provide the actual trade date linked with the margin statement.

For instance, if you have engaged in any trading activities on April 28th, the trade day statement will reflect the same

- Total Margins Available: The sum of funds and value of securities after a haircut. An investor examines the total amount reserved in exchange for their holdings. It is provided for each trade segment separately.

- Margin status: This displays the money available for opening new positions on the next trading day.

- Consolidated Crystallized Obligation: The MTM margin required for all unresolved deals is displayed in this section.

- MTM: Check this section for mark-to-market losses.

- Total requirement: This part displays the full amount the exchange has stopped for your holdings. Each trade segment’s real need is indicated.

Understanding the Margin Concept

A margin can be either the rate set by a stock exchange or a clearing business. Few brokers also provide margins for stock trading. Investors experienced in trading derivatives know the margin needed. However, this is an unexpected territory for cash sector investors.

Stockbrokers are obligated by SEBI rules to collect three distinct margins from cash market participants. These are some examples:

- Value at stake

- Mark to market

- Extreme loss margin

While derivative traders need all three requirements to be met, it is a new cash trading requirement. Margin is an advance sum collected from investors to act as a buffer for all buy/sell transactions that occur in the market. Failure to provide the requisite margin will result in transaction cancellation and a penalty. Because of the margin requirement, SEBI has now mandated that brokers furnish a margin statement to traders to be informed of their shortfalls and potential fines when trading.

- Bank guarantees/fixed deposits: This section offers information on the first margin available after giving a bank guarantee or a fixed deposit. It’s often given against stock derivatives or currency segments in the daily margin statement.

- Any other acceptable form of margin: An initial margin is required to trade in the stock derivatives or currency derivatives segments.

- Total upfront margin: This portion includes the amount of the investor’s entire SPAN, exposure margin, and option premium purchase blocked for positions taken.

Conclusion:

The daily margin statement provides a complete picture of the margin status, including the money paid into the margin, the amount used, etc. This statement is password-protected, and you can access it by providing your PAN as the password. In addition, each trade includes a margin requirement.

You can import your stock portfolio from any platform to Kuvera and then track it on the dashboard.

FAQs on Daily Margin Statement:

-

Why is there a negative value in the ‘fund’ row for me?

Margin status is negative (balance with member / due from customer). It signifies that the client has utilized more funds than were available, and no further funds are available for trading the next day.

-

What is the client’s margin status?

This column shows the balance available for the next day’s trading session.

-

Is a margin necessary when selling stock?

A short sale necessitates margin since the procedure involves selling borrowed stock rather than owning stock. The amount of margin necessary when the transaction is launched is called the initial margin. Whereas, the maintenance margin is the amount of margin required during the life of the short sale.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai #KuveraSabseSahiHai!