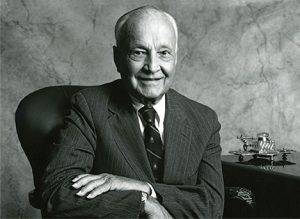

Sir John Templeton (1912-2008) was an American-born British investor, fund manager, and philanthropist who was known for his investment expertise and his contributions to the field of finance.

He was born in Tennessee and studied at Yale University before starting his career as an investment manager in the 1930s. He founded the Templeton Growth Fund in 1954, which became one of the world’s most successful mutual funds, and he also established the Templeton World Fund, which invested in companies outside the United States.

Templeton was a pioneer in international investing, and his investment philosophy emphasized the importance of buying undervalued stocks and investing for the long term. He was also a dedicated philanthropist and founded the John Templeton Foundation, which supports research into the intersection of science and spirituality.

Throughout his life, Templeton received numerous honors and awards, including a knighthood from Queen Elizabeth II in 1987. Today, he is remembered as one of the most successful investors of the 20th century, as well as a generous philanthropist who used his wealth to make a positive impact on the world.

Major achievements of Sir John Templeton:

1. Founding the Templeton Growth Fund: In 1954, Templeton created the Templeton Growth Fund, which became one of the world’s most successful mutual funds. Over the years, the fund consistently outperformed the market, thanks to Templeton’s emphasis on investing in undervalued stocks and his expertise in international investing.

2. Pioneering international investing: Templeton was one of the first investors to recognize the potential of investing in companies outside the United States. He believed that there were many undervalued stocks to be found in foreign markets, and his success in this area helped to establish international investing as an important strategy for investors.

3. Establishing the Templeton World Fund: In addition to the Templeton Growth Fund, Templeton also created the Templeton World Fund, which invested in companies outside the United States. The fund helped to open up new opportunities for investors in emerging markets and other parts of the world.

Now let us take a look at his major investment principles that you should consider following:

1. Historical trends matter

Templeton’s approach to investing is grounded in a belief that history often repeats itself in financial markets. He warned against the dangerous assumption that investors often make, which is to assume that current circumstances are different from past ones and that as a result, different outcomes should be expected. He believed that investors should be wary of making decisions based on the assumption that things have permanently changed and instead pay attention to historical trends.

2. Invest at the point of maximum pessimism

Templeton believed in the importance of investing when people were most pessimistic about the market. He argued that the best time to invest was when prices were undervalued, and when market sentiment was low. He believed that such situations offered investors the most significant opportunities for growth and return on investment. However, he also emphasized that such investments required patience and discipline to see through to the end.

3. Diversify

Templeton stressed the importance of diversification in investing. He believed that by investing in a variety of different stocks and bonds, investors could reduce their risk and increase their chances of achieving long-term success. He argued that a diverse portfolio could balance the ups and downs of individual investments, reducing the impact of losses on a portfolio while allowing investors to capture gains from several investments at the same time.

4. Invest for the long haul

He believed that successful investing required patience and discipline and that investors who were willing to hold onto their investments for a number of years were more likely to see significant returns than those who tried to make quick profits. He argued that investors should be willing to hold onto their investments through market cycles and short-term volatility to achieve long-term financial success.

Overall, Sir John Templeton believed that successful investing required patience, discipline, and a long-term perspective. He believed that investors who were willing to follow these principles could achieve long-term financial success in the market.

Legendary investors have left an indelible mark on the world of finance and investment, and their insights and strategies continue to inspire and inform investors of all backgrounds and experience levels. Whether it’s Warren Buffett’s emphasis on long-term value or Benjamin Graham’s focus on intrinsic value, the lessons and philosophies of these investors offer valuable insights into the art and science of investing. By studying the approaches of these investing legends, we can gain a deeper understanding of the markets, develop sound investment strategies, and potentially achieve long-term financial success. Stay tuned to our “Investing with Legends” series to know more about their investing principles.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai #KuveraSabseSahiHai! #PersonalFinance