Ever since the launch of the new Kuvera platform, we’ve been bombarded with requests to accommodate joint and family accounts on Kuvera.

Bombarded is the correct term here, ’cause there’s no other way to explain the amount of eagerness our user community has shown for joint and family accounts feature.

What’s not to like about this?!

Be it a tech-savvy youngster managing their parents’ investments, or someone investing with their spouse — it’s mighty convenient to have all your joint and family accounts under on login.

One login to rule them all!

As of today, we’re delighted to present you with this option – to create a joint account (multiple investors, in anyone or survivor mode) or individual account (single investor) under a single login as a family account feature.

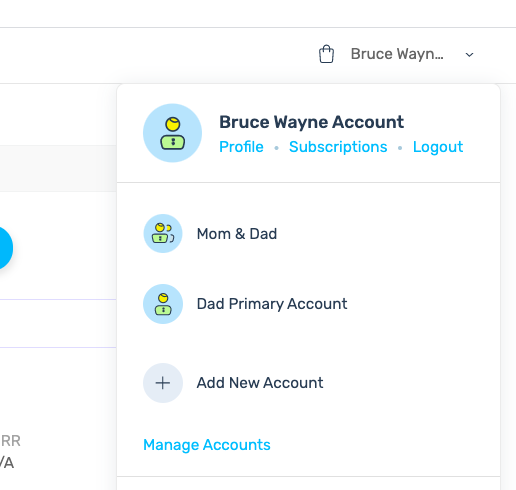

To be able to view this screen, click on your name, top left on web and on the right of navigation hamburger on mobile.

Wealth for your financial goals from just ₹500 per month. Start SIP now.

But How do I Set Up Another Account Under the Same Login?

You’ve to start with the Add New Account link from the screen above.

Once you’ve decided to create an individual account, the process is very similar to what you did when you signed up for the first time.

Except, much easier!

No one likes to fill up forms on the web. So how about we reduce that workload on the user?

Instead of entering PAN, mobile number, date of birth over and over; you can select from users you’ve already added if they’re KYC verified.

Here’s the same screen for a joint account. Notice that this would be created in Anyone or Survivor mode.

For Joint Account, the difference is now you’ve to go through three stages of adding applicant — Primary Holder, Second Holder, Third Holder.

And you cannot add the same applicant twice.

At any stage, you can choose applicant, from the list of applicants you had added earlier; or you can use the Add New Applicant link to add a new KYC verified applicant.

For Joint Accounts, the third holder is optional.

Once you complete this step — either select individual holder from this list, or add a new individual holder who is KYC verified; you would be taken to a confirmation screen, where you can verify and confirm these details.

Refer to similar step for Joint Account setup below

If the account holders are what you’d want, then you need to hit CONFIRM button to go to the next step. Otherwise, you can go back and edit account holders.

This would take you to the bank setup page.

Even here, you’d see options to select banks you have already added — because again, who likes to fill up forms!

You can either select an existing bank from the list of banks you’ve added previously, or add a new one.

Mind you, the bank you add for a new Kuvera account (joint or for a family member) must have one of the account holders’ listed in the bank account.

Which is why you have to select the checkbox before proceeding.

Once your account is all set up, you can start investing and managing all your joint and family member accounts under one login. The simplicity of the Kuvera interface merged with the power of managing multiple accounts in one place.

FAQ: Can I Set Up Minor and HUF Account on Kuvera?

You cannot use the above setup, as of yet, to create a minor account or HUF account. That being said, we’re working on these and will release once we’ve tested internally. Stay tuned!

FAQ: A family member has an existing account with Kuvera. Can I link this account as a family account under my login?

No, an existing family member account (of your wife, husband, father etc) cannot be linked under your login as a family account. Manage Account is a better option for this.

Log in today and consolidate all your Joint and Family accounts under one login. Benefit from all the other goodies, 1-Click switch to Direct Mutual Fund plans and Goal planning.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Panneer Selvam S

June 13, 2018 AT 14:18

Sir, I and spopuse have separate accounts and imported our portfolios. Till now we could not enable smart switch because of not having enough coins. Is there any alternative way. Kindly reply how could we use whatsapp method you were replied to a querry. How could we manage our accounts in a convenient way. I wish to change my investments in direct plans soon after they get out of exit load time by time. Kindly reply and guide me

Gaurav Rastogi

June 16, 2018 AT 04:16

Please email us at support@kuvera.in. Thanks.

Nilesh pandya

January 28, 2021 AT 04:24

Plz start huf in kuvera as soon as possible

Very diffcultu to mange diff platform plz informe me

pragnesh radadiya

June 15, 2018 AT 06:06

what about adding existing family account ?

Gaurav Rastogi

June 16, 2018 AT 04:14

You cannot link multiple existing accounts under the “Family Account” feature. We are building the “Master Account” feature that will allow linking multiple existing accounts under one login. We expect this to be available by the middle of next month.

Sumanth

August 20, 2018 AT 10:24

Hi Gaurav

Is the master account feature available? please let us know when it will be available? Thanks for providing all these nice features. I recently created account for all my family members in kuvera.. 😉

Gaurav Rastogi

August 21, 2018 AT 08:37

you can see manage account feature here – https://blog.kuvera.in/managed-accounts-link-and-invest-across-kuvera-accounts/

Gaurav

April 5, 2020 AT 18:34

Hi Gaurav,

Has the master account feature been activated. I’m new to the portal and struggling with viewing the entire family portfolio (4members) in the same view.

Appreciate your assistance

Gaurav Rastogi

April 9, 2020 AT 13:52

Please email support@kuvera.in for assistance.

Charanjeet Singh

June 15, 2018 AT 07:16

It seems to be good approach, let’s verify.

Brar

July 14, 2018 AT 11:14

Can we invest in dividend plans through kuvera please?

Gaurav Rastogi

July 19, 2018 AT 00:45

Yes, dividend payout options are also available on Kuvera. On the “Explore Funds” page choose the Dividend option.

Karan

November 4, 2019 AT 07:26

Is a minor account on kuvera likely anytime soon. Asking as it shows WIP from a long time now. Do let me know if active plans for including a minor account is worked upon. Thanks.

Gaurav Rastogi

November 6, 2019 AT 02:14

We are working on it. Apologies it has taken longer than we expected.

Karthik Kanniyappan

July 14, 2018 AT 14:36

Looking forward eagerly for the Master account so that family members can individually log in to their accounts respectfully and view/transact and as well as one person in Family (Typically the investment punter of the family ) can as well view and transact on behalf of any family member. This would be a fantastic way to manage investments under one hoodie as well as independence to each of these members to have their independent logins.

Nilesh pandya

January 28, 2021 AT 04:30

How we start with us market it is possible??

We buy foreign market with ligal

Gaurav Rastogi

February 1, 2021 AT 02:49

You can start at https://kuvera.in/explore/us-stocks/list/all

Karthik Kanniyappan

July 14, 2018 AT 14:39

I m also looking forward eagerly for the Minor accounts… The best way to build child investments is when they are minor is to build corpus individually under their name being a minor and transfer everything once they are major…

Dr pradip trivedi

August 21, 2018 AT 04:05

Dear sir….For. SIP…Net banking is required or not

Gaurav Rastogi

August 21, 2018 AT 08:39

Net banking is required to be able to setup mandate to start a SIP.

Arjun Suresh

September 2, 2018 AT 07:19

Dear Gaurav,

Could you please comment when the Master account functionality would be enabled. Any forecasted ETA you have in mind would be greatly appreciated. Also, appreciate the great efforts your team as put in on building these services.

Gaurav Rastogi

September 7, 2018 AT 00:49

Hello Arjun, this has already been released as “Managed” accounts. You can see it here https://blog.kuvera.in/managed-accounts-link-and-invest-across-kuvera-accounts/

Thanks

Gaurav

Subhra

September 6, 2018 AT 07:25

Hey kuvera guys, great platform I must say. I use it regularly. Now that I can add my family members and manage their investment is such an amazing and innovative option. I have a query about if I add my family members as second and third account holder and invest in else schemes then who will get the tax benefits?

Gaurav Rastogi

September 7, 2018 AT 00:46

Hello Subhra, in a joint account, the ELSS benefits can be claimed only by the primary holder.

Hope this answers your question.

Regards

Gaurav

Lovneet

September 9, 2018 AT 12:36

Do you have SIP plus or reliance SIP insure available ….in Direct growth option ?

Gaurav Rastogi

September 11, 2018 AT 02:15

Hello Lovneet, SIP plus will launch shortly. We have ICICI SIP insure, Reliance SIP incure and other AMC SIP insure will be added shortly.

Pratik

November 3, 2018 AT 07:21

Is there any way to see how much dividend has been paid by MF.

Gaurav Rastogi

November 12, 2018 AT 06:49

We are working on it Pratik. Till then download your CAS for this information.

r ralli

November 9, 2018 AT 14:03

How to delete a primary acct after archiving

Gaurav Rastogi

November 12, 2018 AT 06:36

Please deactivate from account settings.

Anup Dutta

November 18, 2018 AT 14:52

In family account, when we go to settings, it shows the email Id of the primary account and not the ID of the individual additional account which I have added.

However, the phone number of added individual account is displayed.

In my opinion, when we see individual detail in account or setting, the Email Id and associated phone number, for the selected account should be displayed. Please look into my suggestion.

Gaurav Rastogi

November 22, 2018 AT 04:51

Thanks for your feedback Anup. We will look into this.

NISHENDU

December 11, 2018 AT 09:44

PL PROVIDE PASSWORD FOR OPENING CAS STATEMENT FROM KARVY

Gaurav Rastogi

December 12, 2018 AT 01:35

If you have generated the CAS from https://kuvera.in/import then the password is “kuvera12”

Saket

December 18, 2018 AT 16:00

Can I keep 1 login for both Investment through NRE and NRO account?

Stalin DSouza

February 1, 2019 AT 12:07

How can I delete the individual accounts?

Gaurav Rastogi

February 2, 2019 AT 07:24

Please deactivate the individual account from https://kuvera.in/profile/settings

ABHAY PRATAP SINGH

February 10, 2019 AT 12:30

I am adding my wife as an individual investor. So, in this case:-

1. will she get tax benefit for ELSS.As her funds will be ELSS and mine will be non-ELSS.

2.different bank accounts can be used to for my and my wife’s SIP?

3. She will get mail of related to her investment ?

4. She can also open a separate account or she need to login using my credentials?

Gaurav Rastogi

February 11, 2019 AT 00:45

1. will she get tax benefit for ELSS.As her funds will be ELSS and mine will be non-ELSS.

If the ELSS is bought in her investment account, only she will get the benefit.

2.different bank accounts can be used to for my and my wife’s SIP?

Yes, different investment accounts can have different banks linked.

3. She will get mail of related to her investment ?

If you setup an email for her investment account then she will.

4. She can also open a separate account or she need to login using my credentials?

If you add her as a family account then she will need to use your login. Else you can setup a separate investment account on Kuvera for her and then add yourself as a manager to that account. https://blog.kuvera.in/managed-accounts-link-and-invest-across-kuvera-accounts/

Dr Sachin Shah

February 14, 2019 AT 16:03

Hi. I want to set up a family account, but I don’t have the necessary coins. What should I do?

Gaurav Rastogi

February 16, 2019 AT 05:28

Please email us at support@kuvera.in

Deepak

March 4, 2019 AT 05:52

Is opening of HUF account functional now ?

Wanted to open a HUF and a minor account for my family.

Please inform when its functional.

Gaurav Rastogi

March 4, 2019 AT 14:28

Dear Deepak, we will announce publicly once HUF and minor account are functional.

Yash

August 20, 2023 AT 18:18

Hi , Kuvera is just great . Have been using it for all my investment in MF. Great portfolio mgt for each goal.

Was looking forward to get investment done for my kids in their names for educational goals.

Is the minor account now available to be opened as a family account? See this feature missing from last 3 years and a reason for considering others apps.

Praveen Srivastava

March 26, 2019 AT 12:03

I am planning to buy 20 lakhs worth of mutual fund in lumption.Kindly advise how can I do that as after successful entry of OTP and NetBanking details money is not getting deducted from my bank account.

Gaurav Rastogi

March 28, 2019 AT 03:17

Hello Praveen, for such queries we request you reach out at support@kuvera.in

It is likely that your third party netbanking limit at your bank is less than 20 lakhs. Please call your bank and update the limit or do the investment in smaller tranches.

Regards

Gaurav

Brijrajsinh

April 10, 2019 AT 07:18

I want to start new sip on my father name under family account but I can not add his name and account number did it required more coins

Gaurav Rastogi

April 10, 2019 AT 13:51

No, if your family account is already active you should be able to add him to your family account. If you are not able to do so, please email us at support@kuvera.in

Ps: do ensure your father is KYC approved to start investing.

George Varghese M

April 16, 2019 AT 13:26

I have a Kuvera account with an NRE account and I want to add an NRO account to my Kuvera account. Since NRIs cannot hold saving accounts, why I cannot add NRO account in Kuvera?

Gaurav Rastogi

April 22, 2019 AT 01:50

NRI’s can add NRO bank accounts to Kuvera.

The same folio cannot have investment from NRE and NRO bank accounts as it leads to issues later. So, request you to add family account and add another individual account for yourself. Use the NRO account from here. So you will have two individual accounts – Geroge NRE and George NRO.

Hope this clarifies.

Srivathsa

November 4, 2019 AT 13:37

Dear Gaurav,

I am an Overseas Citizen of India and recently joined Kuvera on a recommendation and have been exploring various services and options you provide. I have been very impressed so far. The simplicity of able to manage our own funds across various AMCs and different plans, is amazing. I have imported my current holdings, all are Regular plans via an advisor and HDFC securities. I am hoping to convert some of them into direct plans and continue investing in direct plans on my own.

I tried to add my secondary NRO account and it didn’t allow me and I bumped into this article.

In order to add another individual account for my NRO account as you suggest, i would have to enable Family Account, wouldn’t I? That requires some coins. Would you be able to help please?

Or Can I simply create a new login for my NRO account purpose? So it would be 2 separate logins for me, one each for NRE and NRO. Not sure if you would allow 2 logins for same PAN number.

I would like to create another account or login for my wife, who has some MF portfolios through the same advisor and I would like to manage ours in Kuvera via family/ managed accounts.

Thanks

Sri

Gaurav Rastogi

November 6, 2019 AT 01:57

Hello Sri, welcome to the Kuvera family. Request you to email support@kuvera.in for a quick resolution.

Vijaykumar

June 8, 2019 AT 14:56

Hi! I have added my spouse to family account. We both have a common goal. She holds funds in her NRO account and I have funds in my NRE account. Can we do investments from our respective accounts towards the same goal ?

Gaurav Rastogi

June 10, 2019 AT 01:52

Hello Vijaykumar, we do not support common goals yet. What users have done is –

1. Divide goals between accounts. Some in account A and the others in account B.

2. For a large goal, add the goal in both the accounts, with 60% value in account A and 40% value in account B.

Hope this helps.

Kishore. Nimbalkar

June 21, 2019 AT 09:01

Good afternoon

Myself Kishore Nimbalkar have investment. Portfolio with NJ broking and I would like to shift it all in Kuvera

Kindly guide

Gaurav Rastogi

June 24, 2019 AT 03:00

Dear Kishore,

Thank you for writing to our team and welcome to Kuvera.

Thousands of investors have successfully moved their portfolio to Kuvera to save on regular plan commissions or to take advantage of our advanced investing features.

To move completely to Kuvera, we recommend the following steps (the entire process is online) –

1/ Import your existing units to Kuvera so you can track them here

Setup an account with Kuvera and complete KYC check and bank account set up.

After logging in, please follow the steps in the Import Portfolio tab. Do read the “Import Portfolio” FAQ: https://kuvera.in/faq/import

We read and process your Consolidated Account Statement in real time and you can start placing orders in the same folios as your current regular and Direct plans immediately.

2/ Move your SIPs from current platform to Kuvera

START your direct plan SIPs on Kuvera in the same folio as your current plans and then STOP your SIPs with other platforms.

We will ask you to set up a mandate as part of the SIP placement process

Ps: if your regular plan platform does not agree to stop your SIPs (saying you need minimum months etc), read this – https://blog.kuvera.in/how-to-stop-your-sip-when-your-distributor-refuses-to-stop-sip/

3/ Activate TradeSmart and switch your Regular plan units to Direct plan –

Go to the “Portfolio” (https://kuvera.in/holdings) page and click on “Manage”

Choose “Switch” to start switching your regular plans to direct plans

Hope the above helps. Let us know if you get stuck on any step.

Simanchala Pangrahy

September 21, 2019 AT 04:13

Dear Gaurav

Great to see a nice platform where one can invest in direct MF schemes of all AMC’s..

We are holding 8 accounts with icicidirect all regular schemes in demat form.. ours is a combined family and I am managing for all family members- in fact there are families namely one family consists of my self , my spouse, two daughters (one of them is NRO/ NRE) and one HUFac..

The other family is my Son-in-law, his mother & brother..

Want to switch to Kuvera for direct plans…can I get some guidance how to start and if any tele conversation is possible!

Can I call someone who would guide me ?

Gaurav Rastogi

September 22, 2019 AT 12:53

Thanks for your kind words. Please reach out to support@kuvera.in and we can guide you step by step.

Lawrence

October 30, 2019 AT 15:06

Sir I have account and Investment in different platforms. Can they be moved as all those are regular plans and some have running SIPs and some are lump sum. Can I bring them here for review or have I to transfer these investments to Kuvera. I have already Invested 10 lacs through Kuvera which are new investments. I wanted to view all my investment periodic like CAMS and Karvy

Gaurav Rastogi

November 6, 2019 AT 01:59

Sure Lawrence, you can import them to Kuvera. Email us at support@kuvera.in and we will send the detailed instructions. You can also read them at our blog here – https://kuvera.in/blog/automatic-tracking-of-your-external-transactions/

Dipesh shah

February 10, 2020 AT 19:46

Can I add default bank for payout

Gaurav Rastogi

February 15, 2020 AT 07:33

When investing you can set default bank however for redemption, it will go to your linked bank account with your folio. This is for security purpose.

Suresh

March 30, 2020 AT 23:58

suppose i set up family account for my relative and he want to login, do i need to share my login credentials or he can use his credentials?

Gaurav Rastogi

April 9, 2020 AT 13:56

If both want to access, use the Manage account feature.

Sumit Sengal

May 8, 2020 AT 05:54

Any criteria for sell gold

Gaurav Rastogi

May 21, 2020 AT 08:41

None.

Sukhbir Singh

October 13, 2020 AT 13:35

I have a family account with kuvera, in this account one kyc put on hold. What areI do for it for normal functioning of this account.

Gaurav Rastogi

October 17, 2020 AT 06:52

Hello Sukhbir, please email us at support@kuvera.in and we will resolve this.

Baht

October 16, 2020 AT 21:18

Awesome

Sneha Bajpai

March 11, 2021 AT 06:24

Hi..

My account is under the joint and family account but I want a separate account now. Can I unlink my account and get an account of my own while not making any changes to my investment.

Gaurav Rastogi

March 20, 2021 AT 09:07

Please email support@kuvera.in and we will guide

Soumen Bera

May 5, 2021 AT 09:40

I added my wife (individual) in my account.

She then got her own Kuvera app and started SIP. I too invested lumpsum in her name from my account. Will her CAS show all the investments in her name ?

Jagan

May 12, 2021 AT 15:58

When a sale and gain or loss (short or long term) is made from a joint account, under whose income will it be counted? Both equally or any one or only primary holder?

Gaurav Rastogi

May 17, 2021 AT 01:19

Primary holder.

Bushkalai Nathan

July 13, 2021 AT 17:15

How to link family account with already set Goal?

Bharat

July 22, 2021 AT 14:37

I have recently setup a joint family account. Need to change the second and third holders now. I am not seeing any option to do it.

Daya Shankar Singh

December 12, 2021 AT 06:17

By mistake I was added one account in my family……how can I remove her name from my account….I don’t want to see either her name on my account

Gaurav Rastogi

December 15, 2021 AT 01:45

Pls email us at support@kuvera.in You can also remove a family account from the “Manage Account” setting

Ganesh Srinivasan

January 15, 2022 AT 06:42

How to transfer my folio to my wife in family account?

Gaurav Rastogi

January 15, 2022 AT 12:56

Pls email us at support@kuvera.in with details.