Welcome to our journey “Around the World in 5 Currencies,” where we explore the fascinating and diverse world of unique savings habits across different cultures.

Each country has its unique approach to money management, influenced by its economic environment, cultural norms, and historical context. These money habits are passed down from generations and create a part of the unique culture.

Let’s dive into the unique saving habits of five countries, each representing a different currency.

1. Japan: The Art of Kakeibo

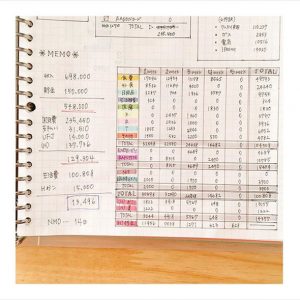

Japan, the land of the rising sun and the Yen, is renowned for its meticulous approach to savings, embodied in the practice of “Kakeibo.” This traditional Japanese method of budgeting, which translates to “household finance ledger,” encourages people to write down their income and expenses meticulously.

The act of writing is believed to make one more mindful about their spending. Kakeibo categorizes expenses into four main groups: survival, optional, culture, and extra. This method not only helps in managing finances but also in cultivating a deeper awareness of one’s spending habits.

2. India: The Concept of Gold Investment

In India, where the Rupee reigns, saving is often synonymous with investing in gold.

Gold is not just a metal but a deeply ingrained part of the culture and tradition. Indian families purchase gold as a form of savings, especially during festivals and weddings. It’s seen as a safe investment that can be liquidated in times of need. Beyond its economic value, gold holds a sentimental value, passed down through generations as family heirlooms.

3. Philippines: The Bayanihan Savings Culture

In the Philippines, where the Peso is the currency, the concept of “Bayanihan” plays a significant role in the culture of savings and community support.

This traditional practice involves community members coming together to help each other in times of need, often translating into financial assistance. One common manifestation is through informal lending circles known as “Paluwagan,” where group members regularly contribute money to a pot, which is then given in full to a different member each cycle. This not only encourages regular saving but also fosters a strong sense of community and mutual financial aid, reflecting the Filipino value of communal unity and cooperation.

This culture of pooling money together exists in multiple cultures such as in South Africa’s Stokvels saving schemes and even in some part of India where kitty parties collect and pool money from it’s members to be given to all members in a regular intervals.

4. China: The Practice of Hóngbāo

In China, where the Yuan is the currency, the tradition of “Hóngbāo” – red envelopes filled with money – plays a significant role in the culture of savings and wealth distribution.

Envelopes are typically given during special occasions like the Lunar New Year, weddings, or birthdays. This practice not only symbolizes good luck and prosperity but also serves as a form of financial gift-giving, encouraging savings from a young age. It reflects a deep-rooted cultural value of sharing wealth within families and communities.

5. Brazil: The Culture of Poupança

In Brazil, where the Real is the currency, the concept of “Poupança,” or savings account, is quite popular. Brazilians use Poupança as a way to save for the future, particularly for times of economic uncertainty. The ease of setting up a Poupança account and its relative stability makes it a favored choice for many Brazilians. This habit reflects the Brazilian approach of planning for the future while navigating the present economic landscape.

Conclusion

Exploring the world’s unique cultural practices around money, from Japan’s disciplined Kakeibo to China’s Hóngbāo tradition and South Africa’s communal Stokvels, illustrates the diverse ways in which different societies approach savings and financial management. These unique savings habits are deeply ingrained in the cultural fabric and offer intriguing insights into the values and societal norms influencing financial behavior.

Understanding these diverse and unique saving habits not only provides insights into different cultures but also offers us a chance to reflect on our approach to savings. Perhaps there’s a lesson or two we can adopt from these global practices to enhance our financial well-being. Happy saving!

Would you like to know more about any of these savings methods or explore other countries and their unique financial habits? Let us know in the comments!

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Check out all our videos on YouTube and get smart about investing