What are Mutual Funds

If you think investing in the stock market is complicated, risky and time-consuming not anymore. Mutual funds helps you invest your money and gain capital on it without getting involved in any of the complicated things mentioned above. A professional manager will be taking care of your investment in order to gain a marginal return on it.

A mutual fund is a professionally managed fund, wherein the Asset management company pools the money from different investors to further invest in securities like stock, bond, money market and other assets. Mutual funds are managed by professional fund managers who allocate the fund in an attempt to gain capital gain or marginal return for the investors, it provides small and new investors to invest in professionally managed funds and earn divided or interest on them.

History of Mutual Funds

The first “pooling of money” for investments was done in 1774. After the 1772-1773 financial crisis, a Dutch merchant Adriaan van Ketwich invited investors to come together to form an investment trust. The objective of the organization was to reduce risks involved in investing by offering diversification to the small investors. The funds invested in numerous European countries such as Spain, Portugal. The investments were largely in bonds, and equity was in small portion. The trust was called Eendragt Maakt Magt.

After developing in Europe for many years, the idea of mutual funds stretched to the US at the end of the nineteenth century. In the year 1893, the first closed-end fund started. It was named as “The Boston Personal Property Trust.”

The first actual open-end fund was the Massachusetts Investors’ Trust of Boston. started in the year 1924, it went public in 1928. 1928 also saw the emergence of the first balanced fund – The Wellington Fund that invested in both stocks and bonds.

Types of Mutual funds

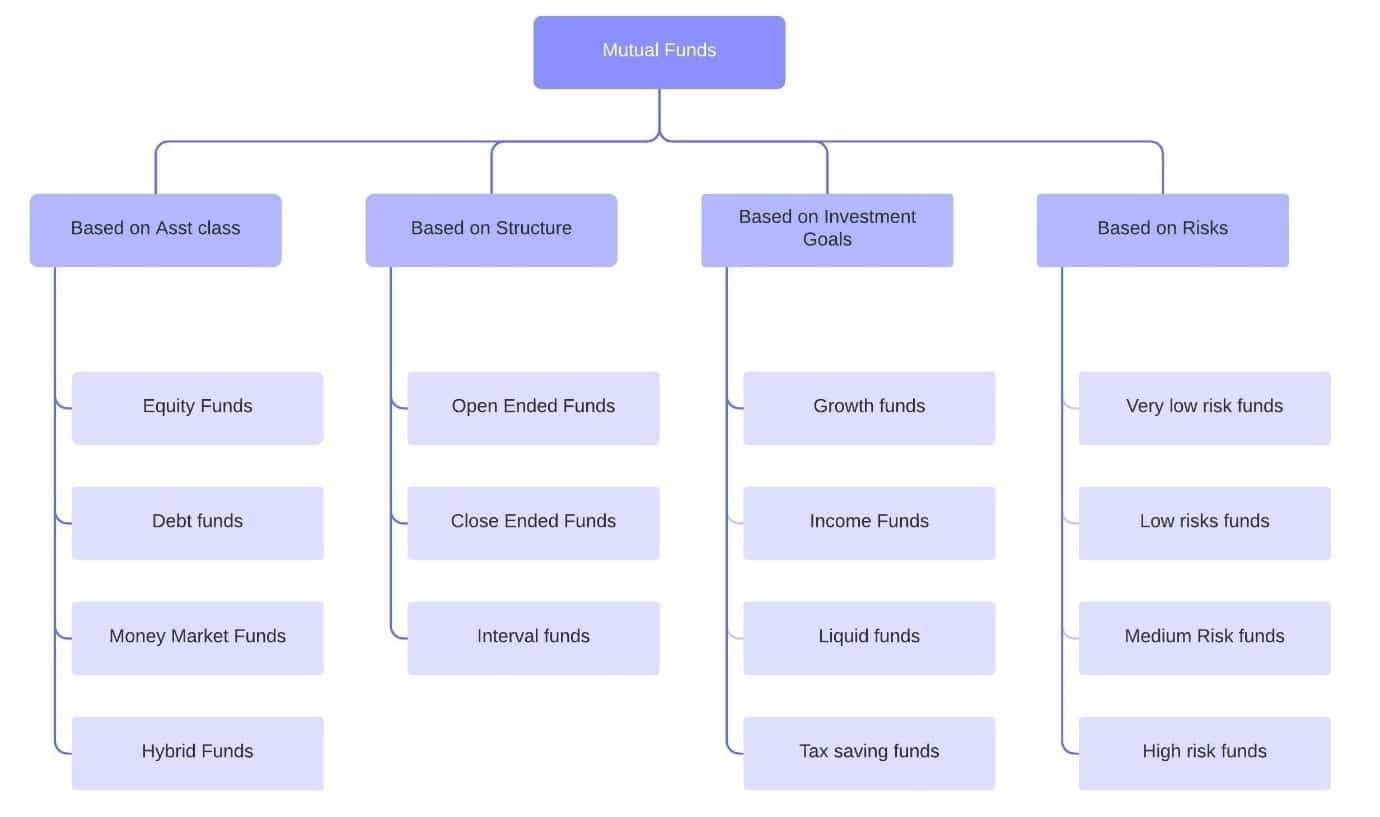

Mutual fund types can be categorised based on the following characteristics.

Based on the asset class

Equity Funds

Equity fund is a fund that typically invest in the stocks. The aim is to seek gain in the long term capital appreciation or earn income from those stock, the risk in the equity fund is comparatively higher as they are directly linked to the market, reward and risk ratio in equity funds is proportional. Hence, more risk leads to more reward, and you may lose some of your invested money too.

Debt funds

Debt funds invest in fixed-income securities like bonds, securities and treasury bills – Fixed Maturity Plans (FMPs), Gilt Fund, Liquid Funds, Short Term Plans, Long Term Bonds and Monthly Income Plans among others – with fixed interest rate and maturity date. The risk associated with these are quite low compared to equity funds as well as the returns.

Money market funds

It is usually run by the government, banks or corporations by issuing money market securities like bonds, T-bills, dated securities and certificate of deposits, among others. The fund manager invests your money and pays a regular dividend to you in return. If you decide on a short-term plan (13 months max), the risk is relatively less.

Hybrid funds

Hybrid funds are an ideal mix of bonds and stocks, thus link the gap between equity funds and debt funds. The proportion can be variable or fixed. In short, it takes the best of two mutual funds by allocating, say, 70% of assets in stocks and the rest in bonds or vice versa. This is apposite for investors ready to take more risks for ‘debt plus returns’ benefit rather than sticking to lower but regular income.

Based on Structure

Open-ended funds

These funds don’t have any restriction on time period or the number of units – an investor can trade funds at their suitability and exit when they like the gain. That is why its funds continuously change with new entries and exits. An open-ended fund may also choose to stop taking in new investors if they do not want to.

Close-ended funds

Here, the unit capital to invest is fixed in advance, and hence, they cannot trade more than a pre-agreed number of units. Some funds also come with an NFO period, in which there is a time limit to buy units. It has a pre-defined maturity period, and fund managers are open to any fund size, yet substantial. SEBI mandates that investors would have either repurchase option or listing on stock exchanges to exit the scheme.

Internal funds

This has characteristics of both open-ended and closed-ended funds. Interval funds can be bought or sold only at specific maturity date and are closed the rest of the time.

Based on Investment goals

Growth funds

Growth funds usually put a huge percentage of shares in growth sectors, fit for investors who have a surplus of idle money to be distributed in riskier plans or are optimistic about the scheme.

Income funds

This belongs to the debt mutual funds that allocate their capital in a mix of bonds, certificate of deposits and securities among others. Helmed by skilled fund managers who keep the portfolio in the cycle with the rate fluctuations without compromising on the portfolio’s wealth, income funds have generally earned investors better returns than deposits and are best suited for risk-averse individuals from a 2-3 years standpoint.

Liquid funds

Like Income Funds, this too fits in the debt fund category as they invest in debt instruments and money market. The maximum sum of 10 lakhs is allowed to invest. One feature that distinguishes Liquid funds from other debt funds is how the Net Asset Value is analysed – NAV of liquid funds are calculated for 365 days including holidays while for others, only business days are calculated.

Tax saving funds

Equity Linked Saving Scheme assist investors with the double benefit of building wealth as well as saving taxes – with the minimum lock-in period of 3 years. Investing mainly in equity (and related products), This is best-suited for long-term and salaried investors.

Based on Risk

Very low-risk funds

Liquid Funds and Short-term Funds (1 month to 1 year) are not risky at all, and ideally, their returns are low. Investors select this to achieve their short-term financial goals and to keep their money safe until then.

Low risks funds

In the event of rupee depreciation or unexpected national crisis, investors are uncertain about investing in riskier funds. In such cases, fund managers advice investing money in either one or a combination of both short-term or arbitrage funds. Returns could be 6-8%, but the investors are free to switch when valuations turn more stable.

Medium Risks funds

In medium risks funds, the risk factor is of moderate level as the fund manager invests a fraction in debt and the rest in equity funds.

High risks funds

Suitable for investors with no risk aversion and aiming to gain more return, High-risk Mutual Funds need active fund management. Regular performance reviews are required as they are vulnerable to market volatility.

Is it safe to invest in Mutual Funds?

Mutual funds are regulated to very high standards by SEBI. They are run by professional fund managers and subject to a great deal of scrutiny and compliance. They will generally invest only in companies that are listed on major stock exchanges, which are also regulated by SEBI. Investments stay in your name at all time, and all money transfers back and forth are through official banking channels. When you invest in a mutual fund, there is no chance of falling victim to a fraud.

Could I lose some of my money?

Yes. Mutual funds investment in market-linked assets, i.e. investments that fluctuate in value based on the stock and bond markets. Mutual funds either invest in debt or equities. Debt is less volatile but also returns less. Equities are more volatile in the short term, but also return more over the long run.

How do I invest in Mutual Funds?

There are many ways through which you can invest in mutual funds, which involves directly getting involved with the asset management company or Broker-they usually charge a significant amount of fees if you invest in mutual funds through them.

You can invest in Mutual Funds in a paperless and hassle-free manner at kuvera.in. Using the following steps, you can start your investment journey by:

- Sign up for an account at kuvera.in

- Register your KYC and bank account

- Start investing.

How do you make money from Mutual Funds?

You can make money in two possible ways

- Income earned from dividends and interest on stocks and bonds, respectively. A mutual fund pays out approximately all of the net profit it collects throughout the year.

- A surge in the worth of securities (called ‘capital gain’)

Further recommended reading

Practical tips for Mutual Fund investors

Start investing today a.ka. the power of compounding

Equity Mutual Funds for the long run

Should I wait for a downturn to invest?

Disclosure

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!