The Indian tax system might seem complex already with jargons and calculations. However, navigating...

Income Tax Deduction

In India, income tax return filing is a mandatory requirement for all taxpayers, including...

If you buy something as an investment and later sell it at a higher price, the money you make is...

As a general rule, everyone with an income has to pay income tax, unless they have certain...

Tax deductions are a valuable tool for reducing your taxable income and maximizing your savings. In...

Deductions under 80C are one...

Income tax is applicable on any income earned in India. The taxation rules applicable for different...

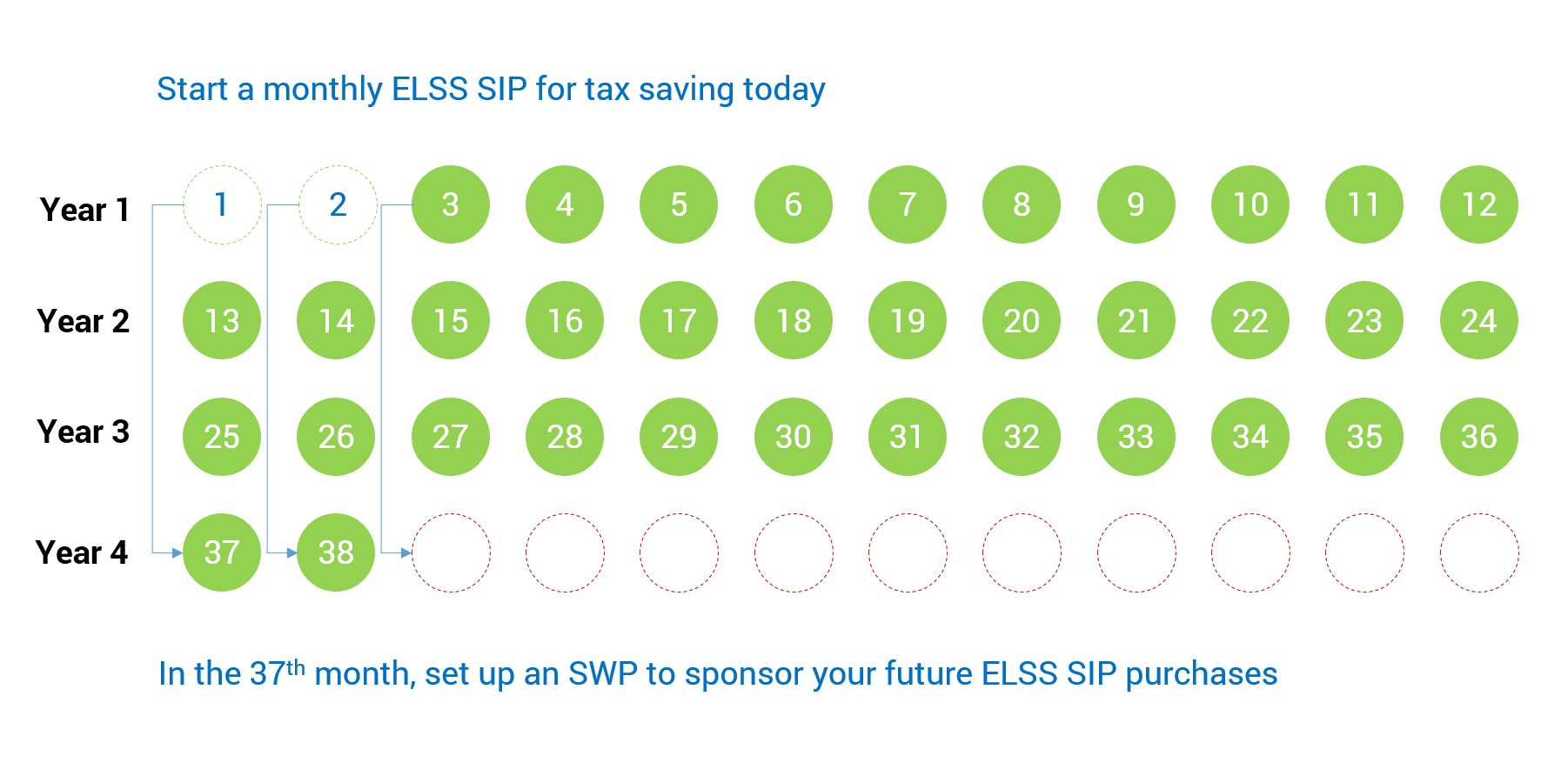

With this simple ELSS Hack, within 3 years your ELSS investment requirements will start taking care...

A fun way to think about ELSS as a tax saving option. Take a look. Thank you Templeton...

Our friends over at Axis MF have prepared a short crisp video on how you can save upto Rs 46,350 in...